Role:

Product designer

Working with:

Founder, Design team

Year:

2023

Problem:

In the modern world, where digitalization encompasses more and more aspects of life, many users still experience a lack of convenient access to banking services. Traditional methods of banking often require visits to branches, long queues, and complex procedures. This creates a barrier to quick and efficient personal financial management.

Goal:

Develop the design of a mobile banking application that simulates easy access and efficient management of financial services, allowing users to experience the benefits of digitization of banking services and reducing their need to visit physical branches.

Research:

At the initial stage of developing the banking application, I encountered a series of challenges, having only a primary idea and functional requirements. My main task was to transform these ideas into a technically justified plan, taking into account risks, technical possibilities, and user needs

I conducted a series of interviews to identify the needs, fears, and expectations of users. Here are some key insights I gained:

Need for Security and Assurance: Banking service users primarily seek security and reliability in every operation and interaction.

Fear of Card Non-Delivery: Many users expressed concerns about the possibility that an ordered card might not arrive.

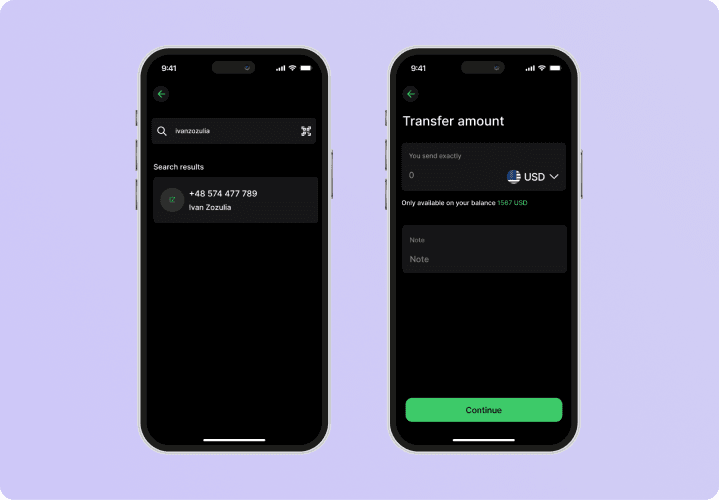

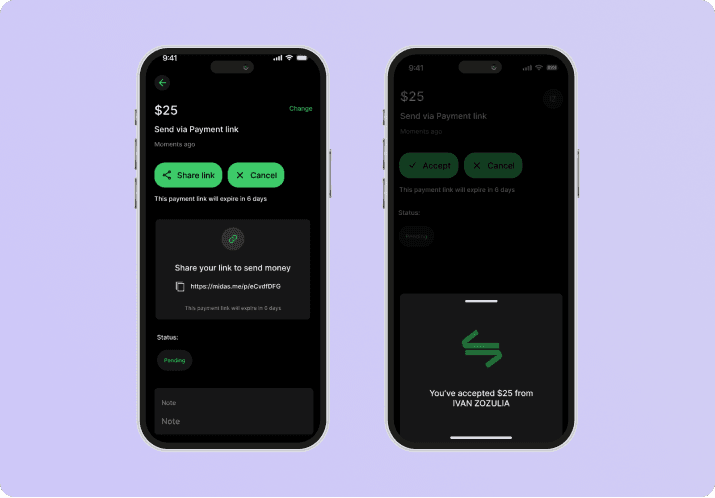

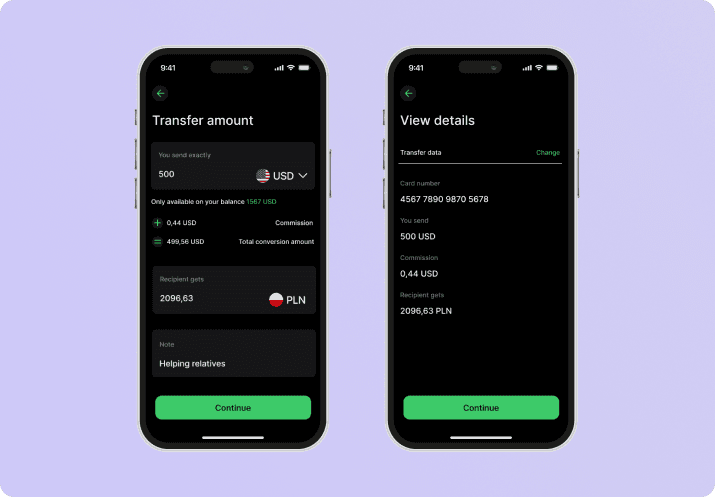

Complexity and Length of Transfers: The stress associated with complicated and lengthy money transfer processes was a frequently mentioned issue.

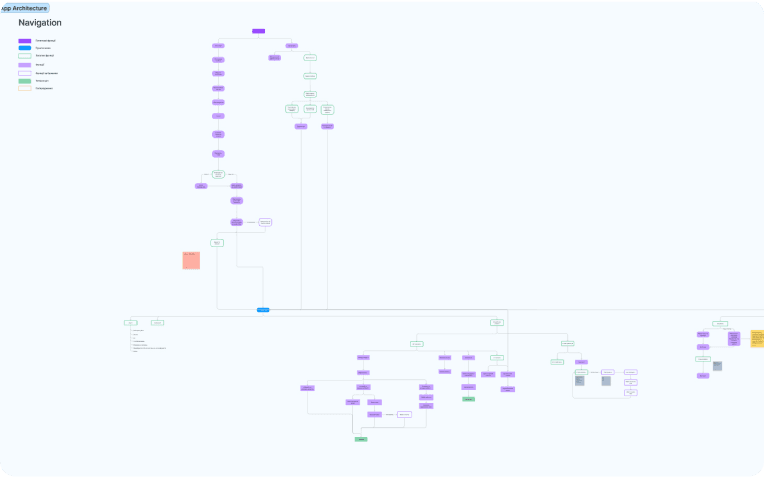

App Architecture:

The program's architecture was designed based on existing patterns and hypotheses, significantly saving us time

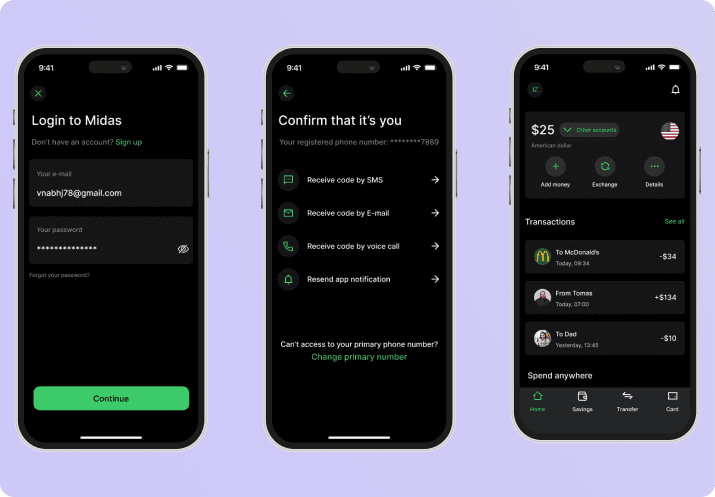

Safety:

Problem:

One of the main fears of users was the possibility of unauthorized access to their financial accounts, as well as the fear of erroneous transactions due to a complicated interface.

Solution:

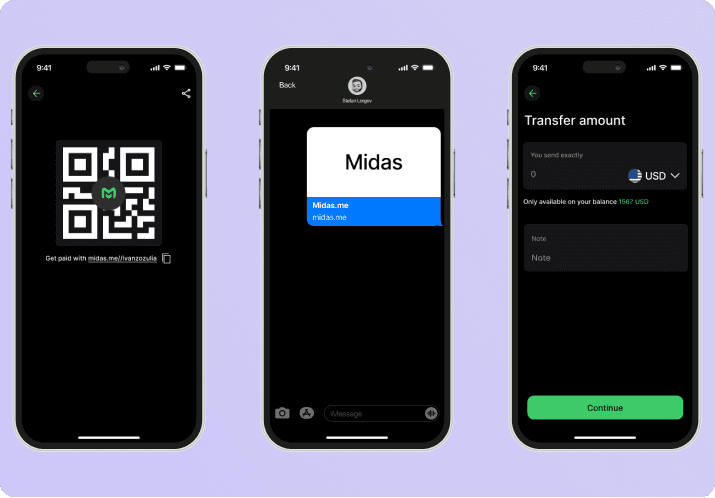

Confirmation Screen for New Devices:

I developed an interactive prototype with a login confirmation screen that activates when attempting to sign in from a new device. This provided users with additional security, knowing that their accounts were protected.

Password for Transaction Confirmation:

I implemented a mandatory password entry for each transaction in the prototype, simulating the real process. This gave users confidence that each of their financial operations was under control.

Transaction Verification Screen:

To reduce the fear of erroneous transactions, I developed a screen where users could review all transaction details before completing it.

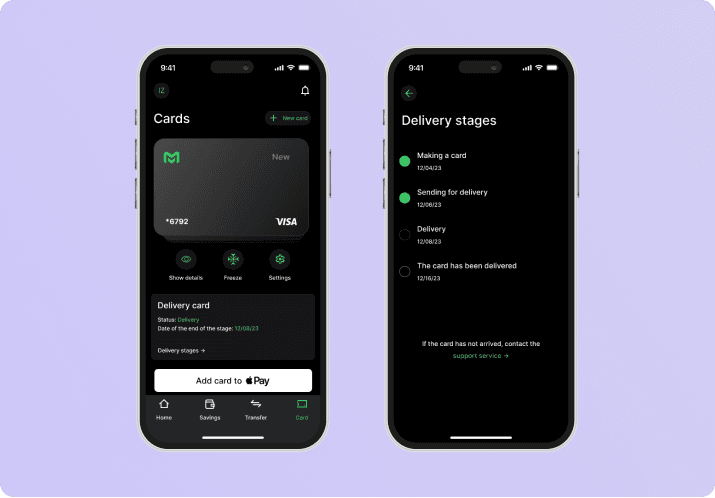

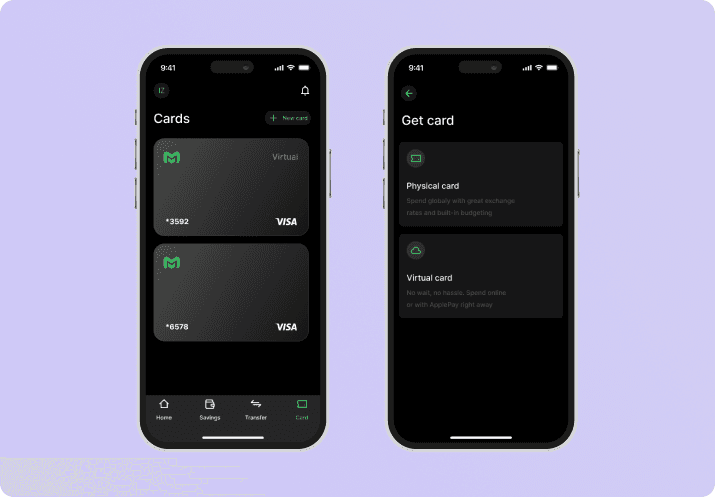

Cards:

Problem:

Users often faced difficulties and the lengthy process of ordering cards. There were also concerns about the possibility of cards not being delivered, especially in the case of physical cards.

Solution:

Simplifying the Ordering Process:

I developed ordering scenarios that demonstrate a simple and fast process for ordering both types of cards – physical and virtual. This allowed users to easily navigate the process and order cards without unnecessary delays.

Card Status Screen:

To dispel user fears about card non-delivery, I created a card status screen with detailed information about the stages of order processing and instructions in case the card does not arrive.